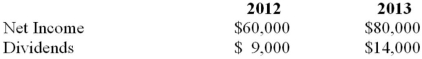

On January 1, 2012, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common stock and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair market value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively. On January 1, 2013, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair market values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful life was revised to 5 years on this date. Marvin's net Income and dividends for 2012 and 2013 are as follows:  Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What would be the balance in Hanson's investment in Marvin account on December 31, 2013?

Marvin's goodwill suffered an impairment loss of $5,000 during 2012. Hanson Inc. uses the equity method to account for its investment in Marvin Inc. What would be the balance in Hanson's investment in Marvin account on December 31, 2013?

Definitions:

Price System

A mechanism through which prices are determined for goods and services in an economy, guiding and coordinating economic actions by conveying information about relative market values and scarce resources.

Capital Source

The origins of the funds or assets that are invested in a business or project.

Public Goods

Goods that are non-excludable and non-rivalrous, meaning they can be used by multiple people without depleting the supply.

Provision

A specified amount set aside for future expenses or reductions in asset value, typically used in accounting and financial reporting.

Q11: Which of the following is NOT a

Q12: Hot Inc. owns 60% of Cold Inc,

Q13: You want to buy a new car

Q15: Inventory holding costs typically include:<br>A) clerical costs

Q34: How should the acquisition cost of a

Q36: If a business combination occurs and the

Q44: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" On December 1,

Q61: The accounting records of Stingray Company revealed

Q62: If the joint production costs are allocated

Q68: Soprano Corporation allocates administrative costs on the