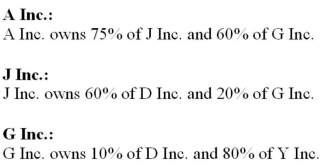

The following information pertains to the shareholdings of an affiliated group of companies. The respective ownership interest of each company is outlined below.  All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:

All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:  Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:

Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:  All companies are subject to a 25% tax rate. How much is the non-controlling interest in A Inc.'s Consolidated Net Income for 2012?

All companies are subject to a 25% tax rate. How much is the non-controlling interest in A Inc.'s Consolidated Net Income for 2012?

Definitions:

Small Investor

An individual investor who makes relatively small amounts of investments in the stock market or other financial markets, often with limited resources.

Mutual Funds

Mutual funds are investment vehicles comprised of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments, and other assets.

Abnormal Return

A term in finance that refers to the difference between an actual investment return and the expected return, based on the asset's risk and market movements.

Fourth Quarter Earnings

The financial performance of a company in the final quarter of its fiscal year, often used as an indicator of annual performance.

Q2: The true statement about cost behavior is

Q4: Starting in 2011, what is the definition

Q13: The reorder point is:<br>A) 25 packages.<br>B) 50

Q21: When using the cost method of accounting,

Q24: Which of the following would not be

Q32: Which of the following is NOT currently

Q33: John Inc and Victor Inc for its

Q40: The chief managerial and financial accountant of

Q42: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" GWN

Q52: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Compute