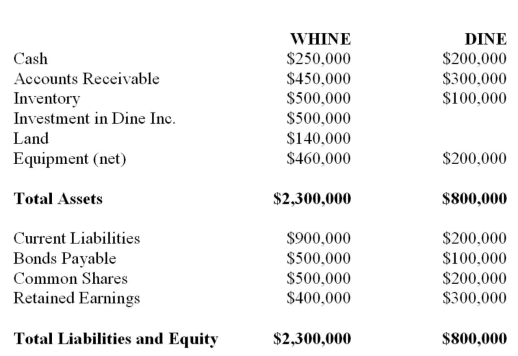

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2012. The Balance Sheets of both companies on that date are shown below (after Whine acquired the shares) :  Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be the gain or loss arising from Dine's share issue to Chompster?

Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be the gain or loss arising from Dine's share issue to Chompster?

Definitions:

Dog Treats

Edible rewards used for training, rewarding, or spoiling dogs, often made to support canine health, dental hygiene, or dietary needs.

Smooches

Informal term for kisses or expressions of affection, typically on the lips or cheek.

Punisher

A stimulus that follows a behavior and decreases the likelihood of that behavior being repeated, often used in behavioral conditioning.

Behaviour Probability

The likelihood that a specific action or response will occur, often influenced by past reinforcement or punishment.

Q2: Kho Inc. purchased 90% of the voting

Q9: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q13: Using the direct method, the amount of

Q16: Any excess of fair value over book

Q22: When underapplied or overapplied manufacturing overhead is

Q47: On July 1, 2013, Great White North

Q50: Which of the following statements is correct?<br>A)

Q65: Bonanza Enterprises provides consulting services and uses

Q67: Managerial accountants:<br>A) often work with regulators like

Q99: As activity decreases, unit variable cost:<br>A) increases