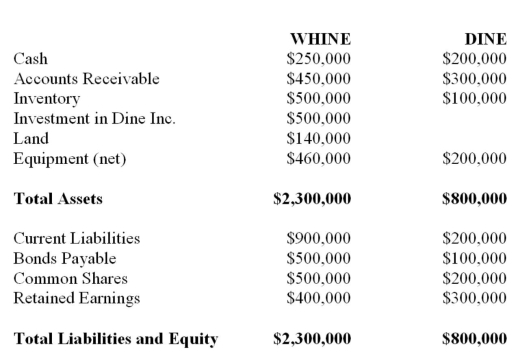

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2012. chapters) the shares) :  Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be the amount of the non-controlling interest appearing on Whine's Consolidated Balance Sheet as at December 31, 2012 before the issue of shares to Chompster?

Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be the amount of the non-controlling interest appearing on Whine's Consolidated Balance Sheet as at December 31, 2012 before the issue of shares to Chompster?

Definitions:

Bond Liability

The obligation of the issuer of the bond to repay the principal amount along with interest to the bondholders on specified dates.

Premium

An amount paid in excess of a standard rate or value, often associated with insurance costs or bond prices.

Fiscal Year-end

The end of a 12-month period used by governments and businesses for accounting and financial reporting purposes.

Par Value

The face value of a bond or stock as stated by the issuing company, which bears no correlation to its market value.

Q1: In which of the following situations is

Q6: Kho Inc. purchased 90% of the voting

Q8: King Corp. owns 80% of Kong Corp.

Q16: Under section 404 of the Sarbanes-Oxley Act,

Q25: Whine purchased 80% of the outstanding voting

Q30: Find Corp and has elected to use

Q35: Electricity costs that were incurred by a

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q44: There are a number of theories of

Q58: How should that portion of investment income