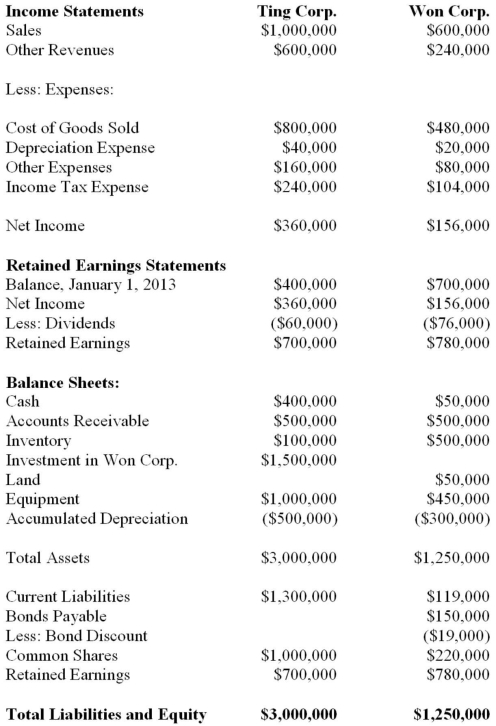

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, chapters) for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. The amount of goodwill arising from this business combination is:

Definitions:

Stress

A physical or emotional response to demands or pressures, which can come from any situation or thought that makes you feel frustrated, angry, or nervous.

Cognitive Problems

difficulties or impairments in mental processes such as memory, attention, problem-solving, and reasoning.

Language Delay

A type of developmental delay where a child is significantly behind their peers in the acquisition of language skills, including speaking, understanding, or both.

ADHD

Attention-Deficit/Hyperactivity Disorder, a neurodevelopmental disorder characterized by levels of inattention, disorganization, and/or hyperactivity-impulsivity that are not appropriate for a person's age.

Q4: The capacity concept that allows for normal

Q10: Nelson Company owes money to Nash Company

Q14: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" At

Q15: Construct a <span class="ql-formula" data-value="95

Q29: Consider the following statements about joint product

Q38: Which of the following pertaining to Consolidated

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q42: Which of the following regarding the preparation

Q51: Jay Inc. owns 80% of Tesla Inc.

Q55: Telecom Inc has decided to purchase the