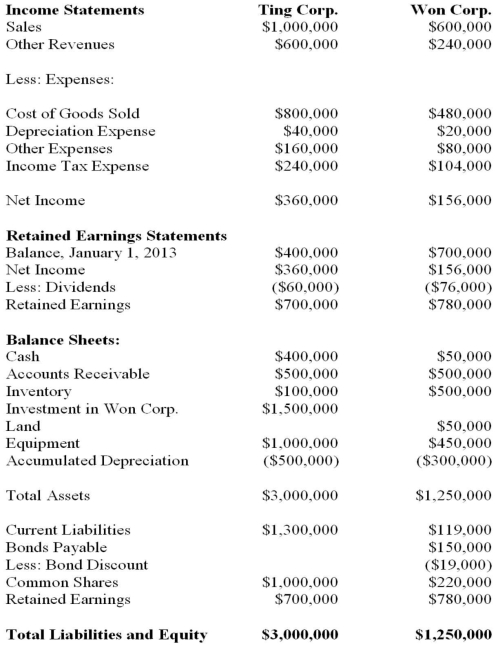

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, which it acquired on January 1, 2013. The Financial Statements of Ting Corp. and Won Corp. for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What effect would the intercompany bond sale have on Won?

Definitions:

False Dilemma

Responses to complex issues are reduced to an either/or choice.

Fifteenth Amendment

An amendment to the United States Constitution that prohibits the federal and state governments from denying a citizen the right to vote based on that citizen's "race, color, or previous condition of servitude."

Elizabeth Cady Stanton

A leading figure of the early women's rights movement in the United States, known for her advocacy for women's suffrage and equality.

Analytic Communication

The process of breaking down complex information into simpler parts for clearer understanding and more effective communication.

Q8: Prior to the implementation of IFRSs in

Q18: One weakness associated with the Entity Theory

Q20: According to GAAP, what is the key

Q21: To help consumers assess the risks

Q22: When allocating service department costs, companies should

Q25: When are profits from intercompany land sales

Q37: Which of the following is a major

Q39: LEO Inc. acquired a 60% interest in

Q42: On January 1, 2012, Hanson Inc. purchased

Q45: During an acquisition, when should intangible assets