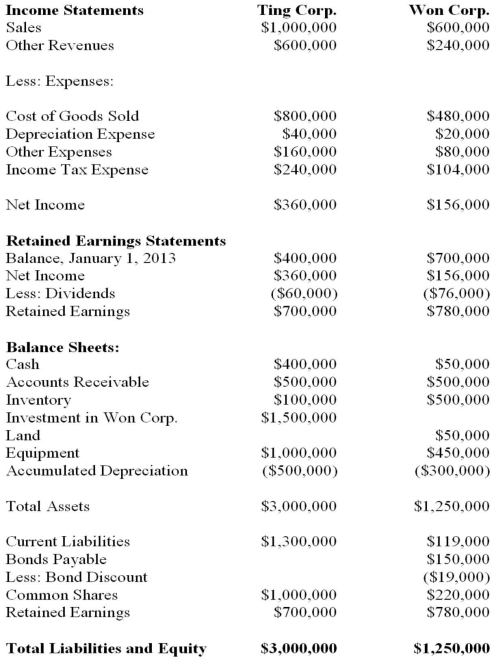

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, which it acquired on January 1, 2013. The Financial Statements of Ting Corp. and Won Corp. for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. Ignoring income taxes, what is the amount of profit/(loss) realized during 2013 from the intercompany sale of equipment?

Definitions:

Electronic Claims Tracking (ECT)

Computer software designed for monitoring insurance claims.

24-Hour Rolling Claims

Claims process in healthcare that involves submitting insurance claims within 24 hours of a patient's visit to ensure timely filing and potentially faster reimbursement.

UB-04 Form

A standard claim form used by hospitals, nursing facilities, and other inpatient providers to bill medical insurance plans, including Medicare and Medicaid.

CMS-1450

A standard form used in the United States for billing Medicare and Medicaid services, also known as the UB-04 form.

Q7: You received a $5,000 loan at the

Q11: Collins Company, which pays a 10% commission

Q12: 1234567 Inc. is contemplating a Business Combination

Q12: Economic Order Quantity, timing of orders and

Q16: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q18: A series of equivalent cash flows is

Q19: Consolidated Retained Earnings include:<br>A) consolidated net income

Q33: LEO Inc. acquired a 60% interest in

Q51: Find Corp and has elected to use

Q68: Which of the following statements is (are)