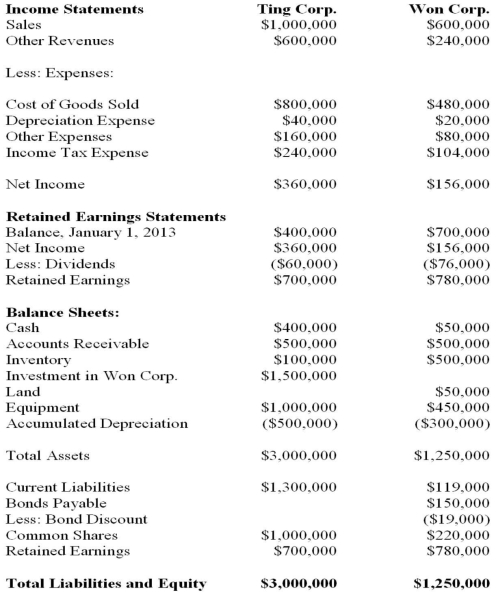

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, chapters) for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What would be the amount appearing on the December 31, 2013 Consolidated Statement of Financial Position for deferred income taxes?

Definitions:

Childhood Experiences

The events, relationships, and learning situations a person encounters during their formative years, significantly impacting development and personality.

Personality Determination

The process by which one's character is shaped, involving both genetic factors and environmental influences.

Wealth And Power

The possession of significant financial resources and the ability to influence or control the behavior of others, often seen in societal and economic contexts.

Freedom Of Choice

The ability or right of individuals to make their own choices without external constraints.

Q3: Broadbent Industries carries a part that is

Q5: At the economic order quantity:<br>A) total annual

Q8: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $686,700. B)

Q9: Any negative goodwill arising on the date

Q27: Under which of the following Theories is

Q32: Which of the following is NOT currently

Q35: Which enterprises must report under IFRSs in

Q49: JNG Corp has 4 segments, the details

Q75: Assuming use of the direct method, over

Q85: Which of the following managerial functions involves