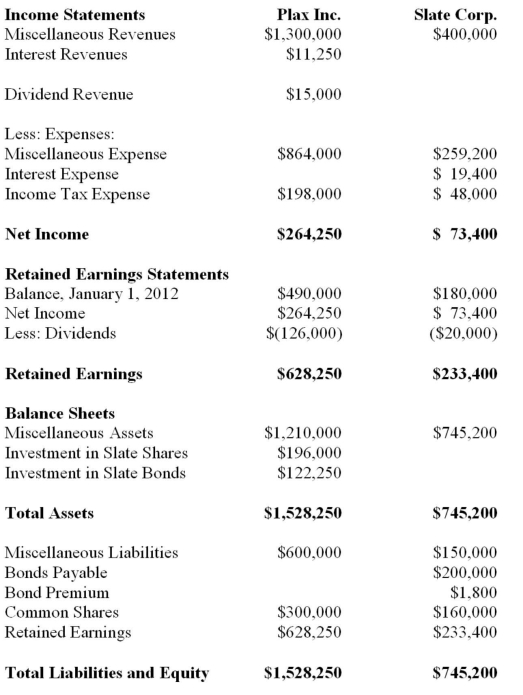

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 are shown below:  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a summary of intercompany bond transactions. Be sure to show the gain or loss for each company as well as the effect on the consolidated entity.

Definitions:

Frame Analysis

A methodological approach to understanding how individuals and groups construct meanings and perspectives.

Irving Goffman

A sociologist known for his studies in the field of symbolic interactionism, focusing on the details of individual identity and social interaction in everyday life.

Emotion Management

involves individuals' efforts to manage their own feelings or display of emotions, often within a social context to adhere to societal norms.

Arlie Hochschild

An American sociologist known for her works on emotional labor, gender roles, and the intersection of work and family.

Q3: A certain confidence in interval is 8.15

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) A loss

Q17: On June 30, 2012, Parent Company sold

Q19: When a not-for-profit organization uses the deferred

Q20: Ting Corp. owns 75% of Won Corp.

Q22: Which of the following would not be

Q43: King Corp. owns 80% of Kong Corp.

Q45: <span class="ql-formula" data-value="\mathrm { E } =

Q45: A cost that is not directly traceable

Q47: On July 1, 2013, Great White North