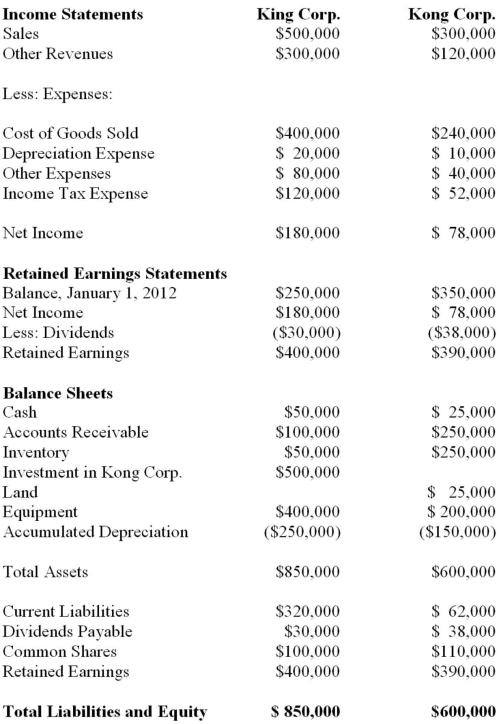

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapter) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What amount of sales revenue would appear on King's Consolidated Income Statement for the year ended December 31, 2012?

Definitions:

Accounts Receivable Period

The amount of time it takes for a company to collect payment from its customers after a sale has been made, indicative of the company's efficiency in collecting its receivables.

Inventory Item

refers to any product or goods that a company holds in stock with the intention of selling it to customers.

Inventory Period

The average time it takes for a company to turn its inventory into sales, indicating how quickly products are sold.

Obsolete Inventory

Items in stock that are out of date or no longer in demand, often leading to reduced value or write-offs.

Q19: Prior to adoption of IFRS in 2011,

Q25: Which of the following statements is correct?<br>A)

Q38: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $360 loss.

Q39: Discuss the disclosure requirements for long term

Q43: The net-realizable-value method is the least preferred

Q47: Parent and Sub Inc. had the following

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) In a

Q59: A random sample of 56 lithium

Q78: The breakdown of costs by departments is

Q114: Rainier Industries has Raw materials inventory on