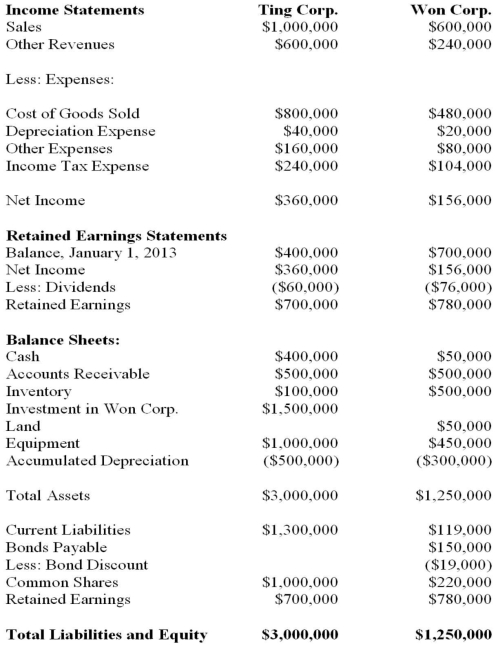

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, which it acquired on January 1, 2013. The Financial Statements of Ting Corp. and Won Corp. for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What effect would the intercompany bond sale have on Won?

Definitions:

Macroeconomic Problem

Issues or challenges affecting an entire economy, such as inflation, unemployment, and economic growth.

Equilibrium Level

In economics, the point at which market supply equals demand, and there is no tendency for change in price or quantity.

Potential Level

The maximum output an economy can produce without leading to inflation, when resources such as labor and capital are fully utilized.

Classical Economists

Economists from the 18th and 19th centuries who focused on the ideas of free markets, the law of supply and demand, and the role of competition in regulating economic activity.

Q3: Which of the following characteristic(s) relate(s) more

Q5: IOU Inc. purchased all of the outstanding

Q14: X Inc. owns 80% of Y Inc.

Q20: Which of the following is a factor

Q31: Because managerial accounting reports rarely solve decision

Q42: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" GWN

Q51: Company Y purchases a controlling interest in

Q79: In a random sample of 60

Q80: Which of the following methods fully recognizes

Q99: As activity decreases, unit variable cost:<br>A) increases