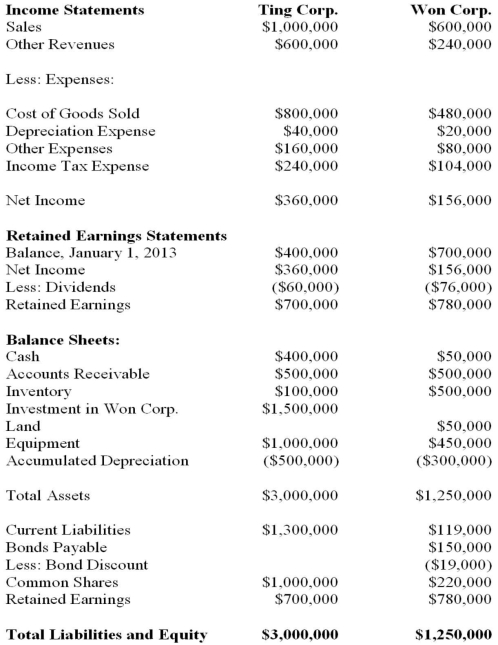

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, chapter) for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What is the total amount of pre-tax profit from intercompany inventory sales that was realized during 2013?

Definitions:

Bioplastic

A type of plastic material derived from renewable biomass sources, such as vegetable fats, oils, corn starch, or microbiota, designed to reduce reliance on fossil fuels.

Renewable Energy

Energy from sources that are naturally replenishing and sustainable over time, such as solar, wind, and hydroelectric power.

Conventional Sources

Traditional practices or methods commonly accepted and widely used in a particular field or industry.

Paperless Billing

A method of billing where bills are sent electronically through email or accessible via an online account, eliminating the need for physical paper bills.

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $100,000. B)

Q5: Conversion costs are:<br>A) direct material, direct labor,

Q6: The nature of managerial accounting reports is

Q12: Which of the following is NOT a

Q24: Ting Corp. owns 75% of Won Corp.

Q28: Which of the following would likely be

Q28: Under which of the following Consolidation Theories

Q34: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q41: Find Corp and has elected to use

Q55: Suppose a <span class="ql-formula" data-value="99