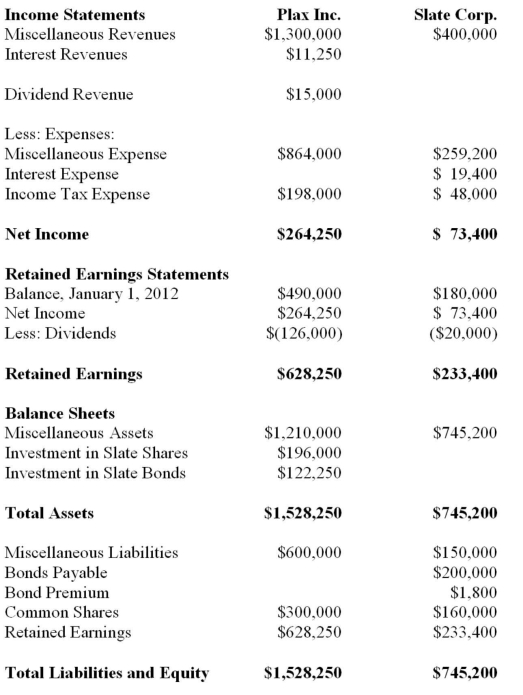

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 chapters)  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Calculate the goodwill as at December 31, 2012.

Definitions:

Ambiguous Faces

Visual stimuli that can be interpreted in more than one way and are often used in psychological experiments to study perception and emotion.

Outgroup Homogeneity

The perception that members of an outgroup are more similar to each other than they actually are, as compared to the ingroup's diversity.

Unjustifiable Negative Behavior

This refers to actions or behaviors that have a negative impact on others or oneself and cannot be logically or morally defended.

Prejudice

Preconceived opinion that is not based on reason or actual experience, often directed towards people or groups.

Q1: The first decade of the SOX legislation

Q8: Which of the following is correct regarding

Q8: Most of the Sarbanes-Oxley Act relates primarily

Q19: When a not-for-profit organization uses the deferred

Q30: Grassley Corporation allocates administrative costs on the

Q30: On January 1, 2012, Hanson Inc. purchased

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q40: John Inc and Victor Inc for its

Q47: Where should be endowment contributions presented in

Q51: Describe the economic characteristics of sunk costs