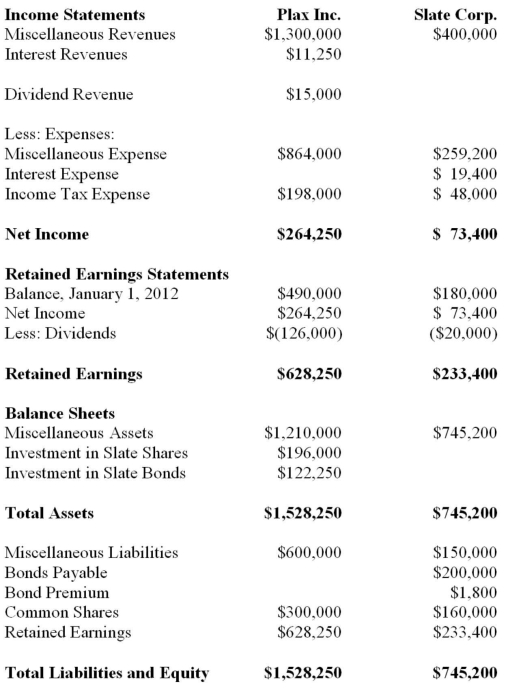

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 are shown below:  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a detailed calculation of consolidated retained earnings as at December 31, 2012. Do not prepare a Statement of Retained Earnings for this requirement.

Definitions:

Ester Reiter's Research

focuses on the study of labor, immigration, women in the workforce, and the sociology of food, particularly within the context of Jewish immigrant culture in Canada.

Quality Of Bad Jobs

An assessment that evaluates the poor conditions or attributes of certain employment positions, such as low pay, lack of benefits, and unsafe working environments.

Labour Market Segmentation

The division of the labour market into distinct subsets, where different rules, wages, and working conditions apply to each segment.

Initial Proletarianization

Initial proletarianization is the beginning phase of the process by which individuals from a non-working class background transition into the working class, often resulting from economic and industrial changes.

Q10: Do-Good Inc. is a newly formed not-for-profit

Q17: If an investment accounted for using the

Q35: How would any management fees charged by

Q43: The net-realizable-value method is the least preferred

Q49: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q55: Which of the following would not be

Q69: Two things that all organizations have in

Q81: Using the step-down method and assuming the

Q85: Which of the following managerial functions involves

Q106: Briefly define and discuss the terms in