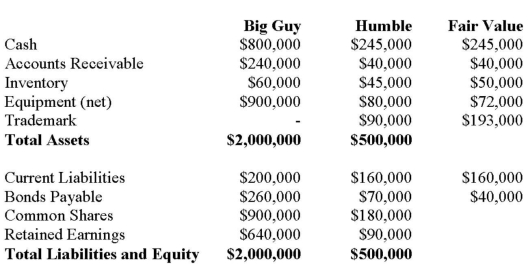

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2011. On that date, Humble Corp. had Common Stock and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2021. Both companies use straight line amortization, and no salvage value is assumed for assets. The trademark is assumed to have an indefinite useful life. Goodwill is tested annually for impairment. The Balance Sheets of Both Companies, as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

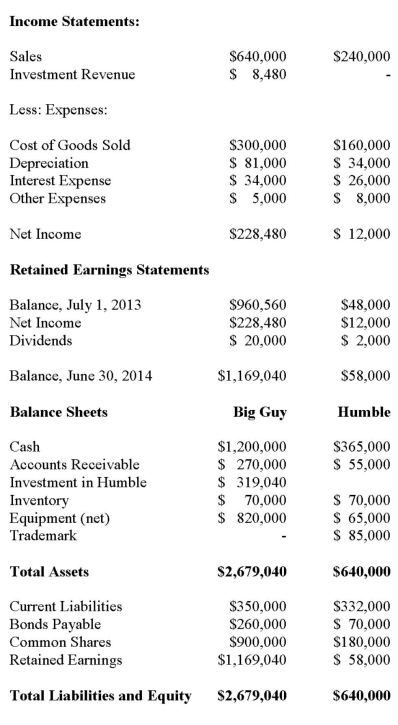

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:  An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of Goodwill arising from this business combination is:

An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of Goodwill arising from this business combination is:

Definitions:

White Pulp

A specialized tissue in the spleen composed mainly of lymphocytes and involved in the immune response.

Capsule

A fibrous, protective covering or layer, frequently surrounding organs or joints.

Qualitative Forecasting

A forecasting method that relies on expert opinions, market research, and comparative analysis rather than numerical data.

Market Intelligence

Information relevant to a company’s markets, gathered and analyzed specifically for the purpose of accurate and confident decision-making in determining market opportunity, market penetration strategy, and market development metrics.

Q1: Whine purchased 80% of the outstanding voting

Q8: Most of the Sarbanes-Oxley Act relates primarily

Q10: Company A makes an offer to purchase

Q28: Find the critical values, <span

Q35: Which enterprises must report under IFRSs in

Q37: After the introduction of the entity method

Q56: Which of the following statements is correct

Q77: Allegiance Corporation has two service departments (S1

Q80: Which of the following methods fully recognizes

Q92: A confidence interval for a parameter is<br>A)