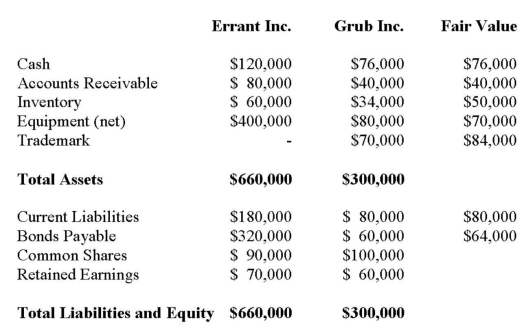

Errant Inc. purchased 100% of the outstanding voting shares of Grub Inc. for $200,000 on January 1, 2012. On that date, Grub Inc. had common stock and retained earnings worth $100,000 and $60,000, respectively. Goodwill is tested annually for impairment. The Balance Sheets of both companies, as well as Grub's fair market values on the date of acquisition are disclosed below:  The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. What would be the journal entry to record the dividends received by Errant during the year?

The net incomes for Errant and Grub for the year ended December 31, 2012 were $160,000 and $90,000 respectively. Grub paid $9,000 in Dividends to Errant during the year. There were no other inter-company transactions during the year. Moreover, an impairment test conducted on December 31, 2012 revealed that the Goodwill should actually have a value of $20,000. Both companies use a FIFO system, and most of Grub's inventory on the date of acquisition was sold during the year. Errant did not declare any dividends during the year. Assume that Errant Inc. uses the Equity Method unless stated otherwise. What would be the journal entry to record the dividends received by Errant during the year?

Definitions:

Romanian Orphans

Refers to children who were institutionalized in overcrowded, underfunded Romanian orphanages during Nicolae Ceaușescu's regime, studied for the impacts of deprivation and social neglect.

Zones of Proximal Development

The difference between what learners can do without help and what they can achieve with guidance and encouragement from a skilled partner.

Lev Vygotsky

Lev Vygotsky was a Russian psychologist who contributed significantly to developmental psychology, especially known for his theories on cultural-historical psychology and the zone of proximal development.

Deferred Imitation

A cognitive behavior observed in children, where they are able to replicate an action after a delay, demonstrating memory and understanding of the behavior.

Q10: A business combination involves a contingent consideration.

Q13: The reorder point is:<br>A) 25 packages.<br>B) 50

Q18: Which of the following statements pertaining to

Q19: When a not-for-profit organization uses the deferred

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) ($5,000). B)

Q32: Briefly list the two types of legal

Q41: Which of the following would not be

Q56: The direct method ignores the fact that

Q63: Assuming use of the step-down method, over

Q69: Two things that all organizations have in