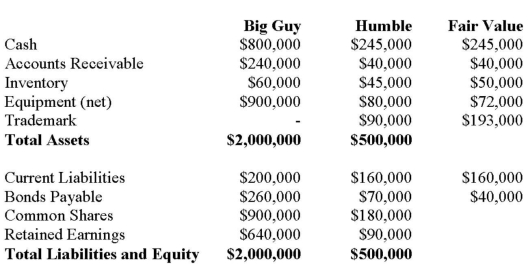

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2011. On that date, Humble Corp. had Common Stock and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2021. Both companies use straight line amortization, and no salvage value is assumed for assets. The trademark is assumed to have an indefinite useful life. Goodwill is tested annually for impairment. The Balance Sheets of Both Companies, as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

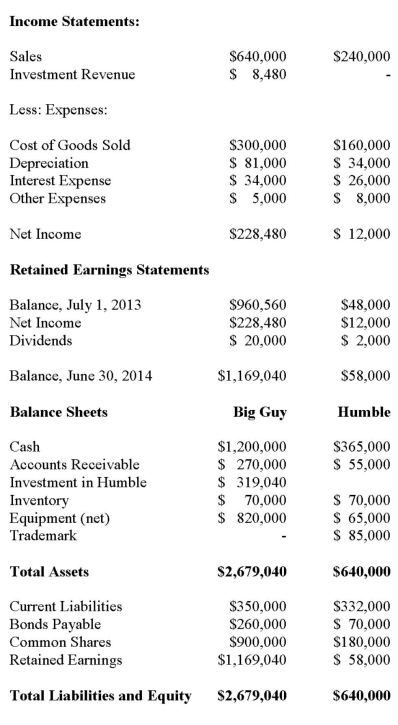

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:  An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of Goodwill arising from this business combination is:

An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of Goodwill arising from this business combination is:

Definitions:

Return on Stocks

The earnings generated from investing in stocks, typically measured in terms of dividend payments and capital gains.

Return on Bonds

Return on bonds is the total income an investor receives from a bond, calculated as a percentage of the bond's purchase price, including interest payments and value appreciation.

Higher Risk

Refers to situations or investments that are more likely to result in loss or have a greater variability of returns.

Efficient Markets Hypothesis

The theory that asset prices reflect all publicly available information about the value of an asset.

Q11: Which of the following is NOT a

Q15: Rin owns 90% of Stempy Inc. On

Q21: To help consumers assess the risks

Q22: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) Nil. B)

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" On January 1,

Q27: Wembley Company has set various goals, and

Q68: The value chain is a managerial accounting

Q70: Midwest Alabama State College has two service

Q82: Managerial accounting activity comprises a set of

Q98: A doctor at a local hospital is