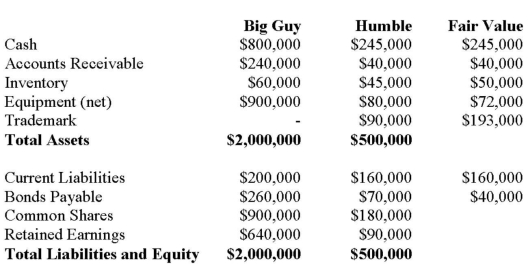

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2011. On that date, Humble Corp. had Common Stock and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2021. Both companies use straight line amortization, and no salvage value is assumed for assets. The trademark is assumed to have an indefinite useful life. Goodwill is tested annually for impairment. The Balance Sheets of Both Companies, as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

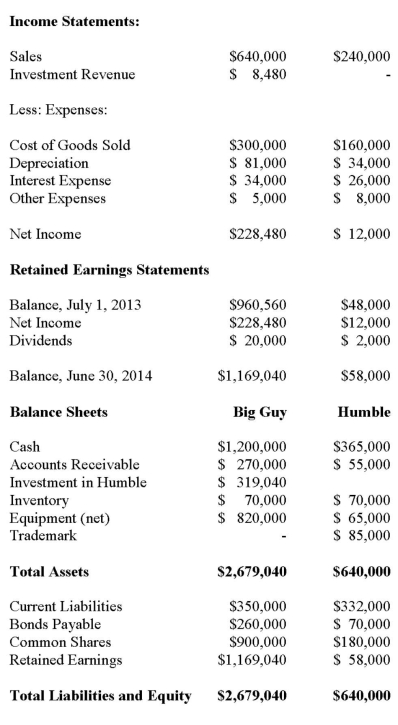

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:  An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of interest expense appearing on Big Guy's June 30, 2014 Consolidated Income Statement would be:

An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of interest expense appearing on Big Guy's June 30, 2014 Consolidated Income Statement would be:

Definitions:

Cash Discount

A reduction in the invoice price offered by sellers to buyers as an incentive for early payment.

Stated Period

A specific time frame that has been mentioned or defined.

Pays Bills

The responsibility of managing and settling financial liabilities such as invoices or debts, often referring to the operational costs of running a business.

Consumer Discount

A reduction in the regular price of goods or services offered to customers.

Q1: Smith is a weld inspector at

Q2: Which of the following statements is correct?<br>A)

Q19: All of the following are common reasons

Q20: Which of the following does not minimize

Q27: Find Corp and has elected to use

Q34: Rin owns 90% of Stempy Inc. On

Q60: Nichols Corporation allocates administrative costs on the

Q80: Which of the following functions is best

Q83: Managers directly involved in the provision of

Q101: A 90% confidence interval for the mean