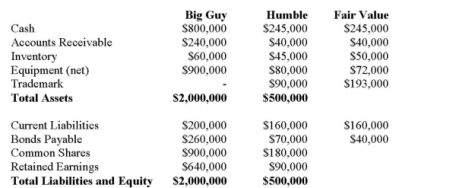

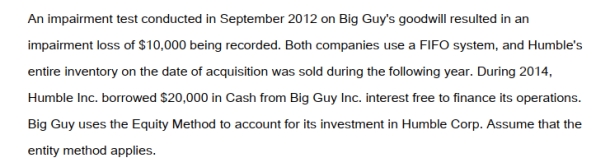

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2011. On that date, Humble Corp. had Common Stock and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2021. Both companies use straight line amortization, and no salvage value is assumed for assets. The trademark is assumed to have an indefinite useful life. Goodwill is tested annually for impairment. The Balance Sheets of Both Companies, as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

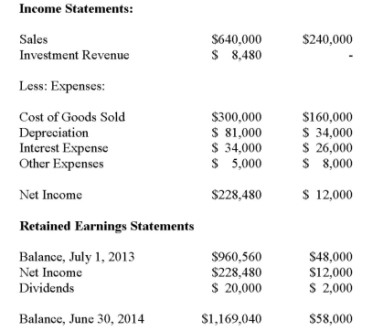

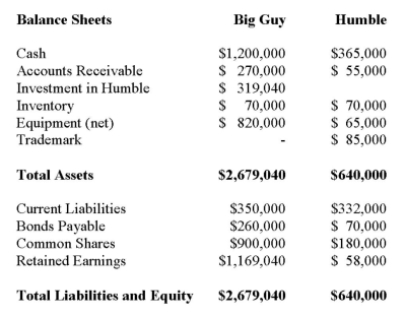

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

Definitions:

Ethics Competency

The ability to understand, develop, and implement decisions based on the ethical considerations relevant to a particular profession or situation.

Product Failures

Situations where a product does not perform as intended or fails to meet consumer expectations, leading to customer dissatisfaction or financial loss for the company.

Vision

An aspirational description of what an organization or individual would like to achieve or accomplish in the mid-term or long-term future.

Performance with Passion

The commitment to excelling in one's efforts or tasks, driven by intense enthusiasm and dedication.

Q7: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $70,500. B)

Q15: Consolidated Net Income is equal to:<br>A) the

Q18: Assume that blood pressure readings are

Q20: A researcher wishes to estimate the

Q33: The consolidation elimination entry required to remove

Q40: Company A has decided to purchase 100%

Q41: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $136,920. B)

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Assuming

Q46: Controlling involves the coordination of daily business

Q60: Construct a <span class="ql-formula" data-value="90