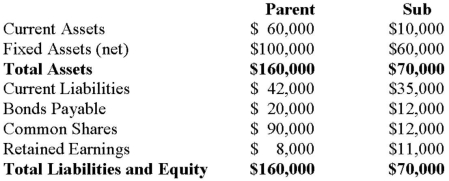

Parent and Sub Inc. had the following balance sheets on December 31, 2012:  On January 1, 2013 Parent purchased all of Sub Inc.'s Common Shares for $40,000 in cash. On that date, Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000, respectively. Assuming that Consolidated Financial Statements were prepared on that date, answer the following: The Fixed Assets of the combined entity should be valued at:

On January 1, 2013 Parent purchased all of Sub Inc.'s Common Shares for $40,000 in cash. On that date, Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000, respectively. Assuming that Consolidated Financial Statements were prepared on that date, answer the following: The Fixed Assets of the combined entity should be valued at:

Definitions:

NASDAQ Composite

An index of over 2,500 stocks listed on the NASDAQ stock exchange, representing a wide range of industries.

S&P 500

An index comprising 500 of the largest companies listed on stock exchanges in the United States.

DJIA

The Dow Jones Industrial Average (DJIA) is a stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States, often used as an indicator of the overall health of the US stock market.

Tax Free Municipal Bond

A debt security issued by a state, municipality, or county to finance its capital expenditures, exempt from federal taxes and, in some cases, state and local taxes.

Q1: The new IASB standard issued with respect

Q2: The rate charged by commercial banks for

Q17: A farmer was interested in determining

Q18: A government department uses an encumbrance system

Q26: Which of the following would NOT be

Q41: If the parent company used the equity

Q42: When the Non-Controlling Interest's share of the

Q44: The amount of money collected by a

Q57: X Ltd. and Y Ltd. formed a

Q78: Construct a <span class="ql-formula" data-value="90