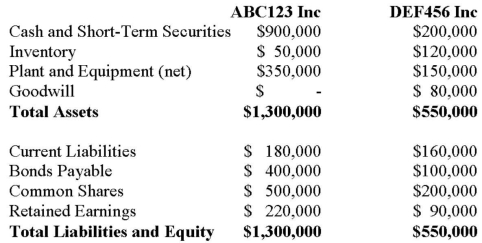

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July 1, 2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of DEF456 Assets and Liabilities were as follows:

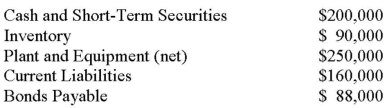

On that date, the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Prepare any disclosure required for ABC123 Inc. under IFRS. Assume DEF456 produces high-end loudspeakers for touring musicians.

In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Prepare any disclosure required for ABC123 Inc. under IFRS. Assume DEF456 produces high-end loudspeakers for touring musicians.

Definitions:

Premature Birth

The birth of a baby before the standard period of pregnancy is completed, typically before 37 weeks of gestation, which may lead to several health challenges for the infant.

Germinal

Referring to the earliest stage of development after fertilization, when the organism is a rapidly dividing mass of cells.

Embryonic

Referring to the early stages of development within the womb, from conception to the eighth week of pregnancy.

Fetal

Pertaining to the development stage of a human between the embryonic state and birth.

Q17: If an investment accounted for using the

Q21: King Corp. owns 80% of Kong Corp.

Q23: Canada and the U.S. both experimented with

Q24: A university dean is interested in

Q28: Ting Corp. owns 75% of Won Corp.

Q36: The diameter of ball bearings produced in

Q51: The calculation of Goodwill and Non-Controlling Interest

Q51: Company Y purchases a controlling interest in

Q56: Find the area under the standard

Q59: Alcor and Vax Inc, both Canadian private