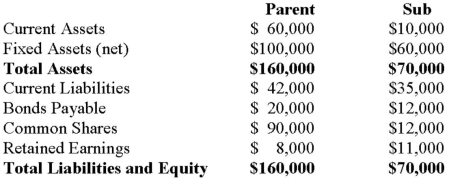

Parent and Sub Inc. had the following balance sheets on December 31, 2012:  On January 1, 2013 Parent purchased all of Sub Inc.'s Common Shares for $40,000 in cash. On that date, Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000, respectively. Assuming that Consolidated Financial Statements were prepared on that date, answer the following: The Goodwill arising from this Business Combination would be:

On January 1, 2013 Parent purchased all of Sub Inc.'s Common Shares for $40,000 in cash. On that date, Sub's Current Assets and Fixed Assets were worth $26,000 and $54,000, respectively. Assuming that Consolidated Financial Statements were prepared on that date, answer the following: The Goodwill arising from this Business Combination would be:

Definitions:

Historical Comparisons

The analysis of past data to identify trends, patterns, or changes over time, often used in financial analysis.

Competition Comparisons

An analysis technique used by companies to evaluate their position relative to competitors in the market, focusing on strengths, weaknesses, opportunities, and threats.

Market Value Ratios

Financial metrics used to evaluate the attractiveness of an investment by comparing its share price to various per-share financial metrics.

Liquidity Ratios

Financial metrics used to determine a company's ability to meet its short-term debt obligations.

Q9: Consider the descriptors that follow.<br>1. Is heavily

Q15: Rin owns 90% of Stempy Inc. On

Q27: The tread life of a particular brand

Q41: Find Corp and has elected to use

Q42: Rave Reviews uses the direct method of

Q46: Any goodwill on the subsidiary company's books

Q49: Assuming use of the direct method, over

Q54: Rave Reviews uses the direct method of

Q96: A standardized test has a mean of

Q121: Find the area under the standard