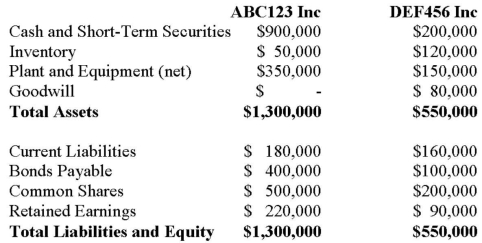

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July 1, 2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of DEF456 Assets and Liabilities were as follows:

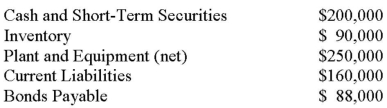

On that date, the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Assume that both companies would be wound up and a new company called ABCDEF Inc. was created in its place. Prepare the Balance Sheet to reflect this occurrence as at July 1, 2012. The new entity would have10,000 voting shares issued to the current shareholders for a total market value of $1,222,000.

In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Assume that both companies would be wound up and a new company called ABCDEF Inc. was created in its place. Prepare the Balance Sheet to reflect this occurrence as at July 1, 2012. The new entity would have10,000 voting shares issued to the current shareholders for a total market value of $1,222,000.

Definitions:

Level Of Significance

A threshold in hypothesis testing that measures the probability of rejecting a null hypothesis when it is actually true, commonly denoted by alpha (α).

Hourly Wages

The amount of money paid to an employee for each hour of work.

Interval Estimate

An estimate of a population parameter that specifies a range within which the parameter is expected to lie, often associated with a confidence level.

Test Statistic

A measure calculated from sample data to make decisions about a population parameter in hypothesis testing.

Q3: Sonic Enterprises Inc has decided to purchase

Q9: LEO Inc. acquired a 60% interest in

Q9: Under the Current Rate Method, which of

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) If an

Q19: In a uniform probability distribution, any random

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q37: Testing intangible assets with indefinite useful lives

Q49: Let to be a specific value

Q57: The mean replacement time for a

Q80: <span class="ql-formula" data-value="\mathrm { E } =