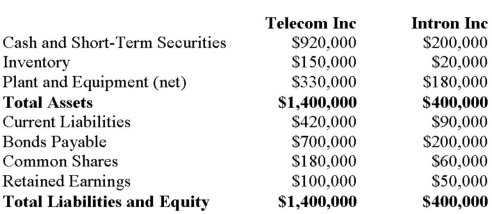

Telecom Inc has decided to purchase the shares of Intron Inc. for $300, 000 in Cash on July 1,2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of Intron's Assets and Liabilities were as follows:

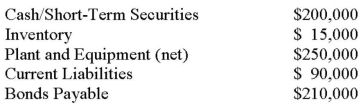

On that date, the fair values of Intron's Assets and Liabilities were as follows:  Assume that two days after the acquisition, the Goodwill was put to an impairment test, after which it was decided that its true value was $70,000. Prepare the necessary journal entry to write-down the goodwill as well as another Consolidated Balance Sheet to reflect the new Goodwill amount.

Assume that two days after the acquisition, the Goodwill was put to an impairment test, after which it was decided that its true value was $70,000. Prepare the necessary journal entry to write-down the goodwill as well as another Consolidated Balance Sheet to reflect the new Goodwill amount.

Definitions:

Q1: Which of the following is not a

Q2: On December 31, 2014, XYZ Inc. has

Q7: The provisions of section 302 of the

Q8: Parent and Sub Inc. had the following

Q22: The time value of money and present

Q25: Find Corp and has elected to use

Q35: Which enterprises must report under IFRSs in

Q37: Clarion Company, a new firm, manufactures two

Q51: Jay Inc. owns 80% of Tesla Inc.

Q114: The failure rate in a German class