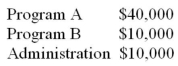

XYZ is a local charity that commenced operations on January 1, 2014. XYZ uses an encumbrance system to manage costs. For the following partial data provided, prepare the journal entry to record that transaction. In addition, specify which fund or funds must be used to record the entry. a) Revenue deferred earlier in the year in the amount of $5,000 was recognized. b) Pledges receivable in the amount of $10,000 were collected in full. c) Accounts payable and wages payable amounting to $10,000 and $5,000 were paid. d) Government grants amounted to $50,000, half of which was received. The balance is expected by late 2015. The grants may be applied to any of the organization's programs. e) Total Wage costs amounted to $60,000 which breaks down as follows:  25% of these expenses are still payable at the end of 2014. f) A wealthy local businessman donated $100,000 to be held in endowment, with the interest earned to be unrestricted. g) The investments in an endowment fund earned interest in the amount $3,000. h) Amortization expense for the year amounted to $10,000.

25% of these expenses are still payable at the end of 2014. f) A wealthy local businessman donated $100,000 to be held in endowment, with the interest earned to be unrestricted. g) The investments in an endowment fund earned interest in the amount $3,000. h) Amortization expense for the year amounted to $10,000.

Definitions:

Critical Thinking Skills

The ability to actively and skillfully conceptualize, apply, analyze, synthesize, and/or evaluate information gathered from observation, experience, reflection, reasoning, or communication.

Nursing Diagnoses

A clinical judgment about individual, family, or community responses to actual or potential health problems/life processes.

Nursing Process

A systematic, problem-solving approach used in nursing practice, involving assessment, diagnosis, planning, implementation, and evaluation to provide effective patient care.

Subjective Data

Information gathered from patient statements; the patient's feelings and perceptions. Not verifiable by another except by inference.

Q6: On December 31, 2014, XYZ Inc. has

Q6: If an investor is reporting in compliance

Q16: The heights of 20 - to

Q18: Which of the following statements is correct?<br>A)

Q25: Find Corp and has elected to use

Q31: The amount of soda a dispensing machine

Q34: A simple random sample of size

Q37: X Inc. owns 80% of Y Inc.

Q46: John Inc and Victor Inc for its

Q141: A history professor decides to give a