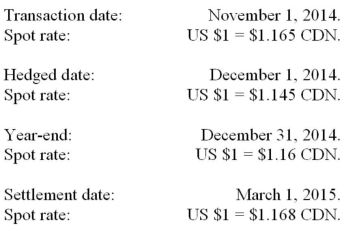

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of the discount on the forward contract?

What is the amount of the discount on the forward contract?

Definitions:

Secondary Research

The process of synthesizing existing research and information, as opposed to collecting new data.

Controlled Before-after

An experimental research design that compares the outcomes of a group subjected to a treatment with its conditions prior to the treatment.

Experimental Design

A systematic method in research for conducting experiments to test hypotheses, involving manipulation of variables to assess their effects on certain outcomes.

Plagiarism

The practice of taking someone else's work or ideas and passing them off as one's own.

Q11: Telecom Inc has decided to purchase the

Q17: JNG Corp has 4 segments, the details

Q21: On June 30, 2012, Parent Company sold

Q33: Assume that two companies wish to engage

Q42: John Inc and Victor Inc for its

Q43: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) 14% B)

Q44: The amount of money collected by a

Q53: Which of the following provides the best

Q63: A survey of 250 households showed

Q66: Given a distribution that follows a standard