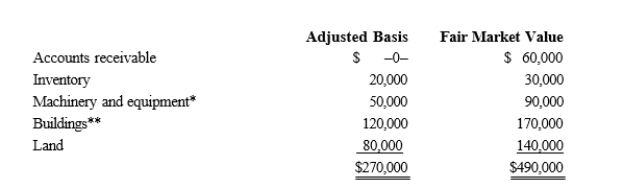

Kristine owns all of the stock of a C corporation which owns the following assets.  * Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

* Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Academic Publishing

The process of publishing scholarly work, including journal articles, books, and conference proceedings, for the academic and research community.

Relevance

The extent to which something is relevant or applicable to the current subject.

Quality

The degree of excellence of something as measured against other similar things; the standard of something as determined by its effectiveness, efficiency, and satisfaction to users.

Boolean Operators

Logical connectors (AND, OR, NOT) used in search engines and databases to refine and combine search terms.

Q7: Techniques that can be used to minimize

Q9: The required adjustment for AMT purposes for

Q19: Discuss three possible explanations for extremely high

Q28: Announcements of layoffs and plant closings never

Q32: Which of the following is a problem

Q46: An S election is made on the

Q60: If a C corporation has earnings and

Q92: The LIFO recapture tax is a variation

Q103: Business purpose

Q107: A newly formed S corporation does not