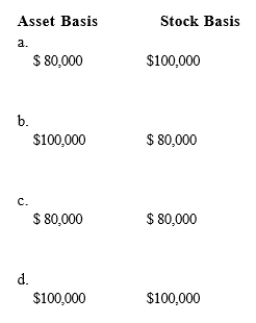

Ruchi contributes property with an adjusted basis of $80,000 and a fair market value of $100,000 to a newly formed business entity.If the entity is a partnership and the transaction qualifies under § 721, the partnership's basis for the property and the partner's basis for the partnership interest are:

Definitions:

Cost of Goods Available

The total cost of inventory that is available for sale at the beginning of a period, including purchases made during that period.

Schedule of Cost

A detailed list showing the various components contributing to the total cost of manufacturing a product or providing a service.

Underapplied Manufacturing Overhead

The situation where the allocated manufacturing overhead costs are less than the actual overhead costs incurred.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold in a company.

Q2: Define competitive advantage.

Q2: Explain the two major categories of total

Q2: Which of the following is true about

Q13: According to the steps involved in formulating

Q19: External competitiveness refers to:<br>A)comparison of product prices

Q24: According to the reinforcement theory of motivation,

Q29: Incentives may be long-term or short-term.

Q30: An internal pay structure is defined by

Q43: Which of the following is true about

Q46: Which of the following is an advantage