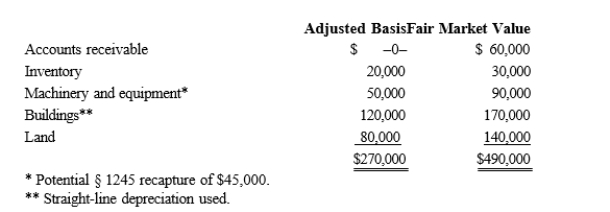

Albert's sole proprietorship owns the following assets.  Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Low-birthweight

A condition in newborns weighing less than 2,500 grams (5 pounds, 8 ounces) at birth, which can lead to health problems.

United States

A country primarily located in North America, consisting of 50 states, a federal district, five major self-governing territories, and various possessions.

International Rates

Refers to the comparison of statistics such as disease prevalence, economic indices, or educational achievement across different countries.

Low-birthweight

Refers to babies born weighing less than 2,500 grams (5.5 pounds), often associated with developmental and health problems.

Q23: A job structure based on job content

Q32: Which of the following is a problem

Q35: What are the different strategies to better

Q40: Both Thu and Tuan own one-half of

Q46: The lists all jobs across columns and

Q47: Julio, a nonresident alien, realizes a gain

Q47: What does a person-based structure focus on?

Q48: What is a factor degree?

Q58: Under P.L.86-272, which of the following transactions

Q103: An S corporation can claim a deduction