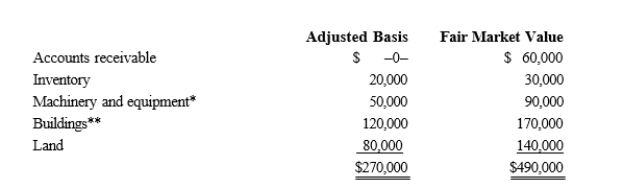

Kristine owns all of the stock of a C corporation which owns the following assets.  * Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

* Potential § 1245 recapture of $45,000. ** Straight-line depreciation was used. Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Interviews

Formal meetings in which one or more persons question, consult, or evaluate another person, often for the purpose of getting information or filling a job position.

Primary Research

Collection of original data through firsthand investigation, such as surveys, interviews, or experiments.

Experiments

Systematic procedures carried out to test hypotheses, observe effects, and study relationships between variables.

Secondary Research

The process of gathering existing data from previously conducted studies and analyses, which are available in books, articles, and online resources.

Q17: The compa-ratio reflects the relationship of:<br>A)red circle

Q29: Give one reason why overtime pay is

Q30: Roughly 5% of all taxes paid by

Q33: USCo, a U.S.corporation, receives $700,000 of foreign-source

Q39: What is the main difference between a

Q48: Meal breaks and rest periods are required

Q70: Elmer exercises an incentive stock option (ISO)

Q78: Most states begin the computation of corporate

Q90: The work opportunity tax credit is available

Q116: Seven years ago, Paul purchased residential rental