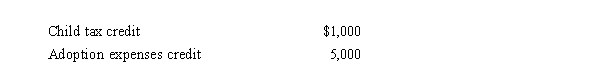

Prior to the effect of the tax credits, Justin's regular income tax liability is $200,000, and his tentative minimum tax is $195,000.Justin reports the following credits.  Calculate Justin's tax liability after credits.

Calculate Justin's tax liability after credits.

Definitions:

Deadweight Losses

Economic inefficiencies that occur when equilibrium in a market is not achieved or when market allocation of resources is not optimal, often due to externalities or government intervention.

Consumer Surplus

A rephrased definition: The economic benefit that consumers receive when they can purchase a product for less than the maximum price they are willing to pay.

Consumer Surplus

The gap between the overall sum consumers are ready and able to spend on a product or service and what they really spend.

Cognitive Dissonance

A psychological discomfort experienced when simultaneously holding two or more conflicting beliefs, ideas, or values.

Q2: Unused foreign tax credits are carried back

Q18: Purple Corporation has accumulated E & P

Q24: What are long-term incentives?

Q28: Which of the following is a step

Q45: In broad-based option plans, stock options are

Q49: Amber is in the process this year

Q87: Seven years ago, Eleanor transferred property she

Q94: The sale of business property could result

Q102: Tax-exempt income at the S corporation level

Q125: Navy Corporation has E & P of