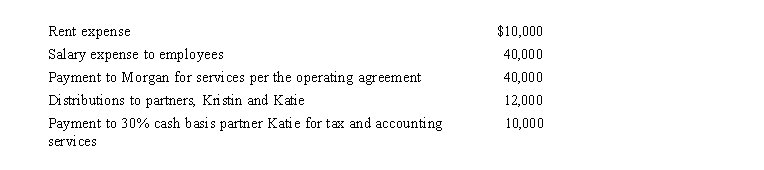

Morgan is a 50% managing member in the calendar year, cash basis MKK LLC.The LLC received $150,000 income from services and paid the following other amounts.  How much will Morgan's adjusted gross income increase as a result of these items? What other deductions must be considered? What amount will be included in Morgan's self-employment tax calculation?

How much will Morgan's adjusted gross income increase as a result of these items? What other deductions must be considered? What amount will be included in Morgan's self-employment tax calculation?

Definitions:

Harassment

Harassment involves unwanted and offensive behavior or actions, which often lead to discomfort or harm for the target individual or group.

Harm Model

A conceptual framework used to determine the morality or ethics of actions based on the amount and type of harm they cause.

Aggression

Behavior intended to harm or intimidate others, either verbally, physically, or psychologically.

Destruction

The process of causing so much damage to something that it no longer exists or cannot be repaired.

Q11: Tara and Robert formed the TR Partnership

Q12: Jacob and Emily were co-owners of a

Q13: When current E & P is positive

Q24: The disabled access credit is computed at

Q53: At the beginning of the current year,

Q56: A benefit of an S corporation when

Q61: An S shareholder's stock basis is reduced

Q78: Xena and Xavier form the XX LLC.Xena

Q92: A taxpayer who expenses circulation expenditures in

Q103: A company has a medical reimbursement plan