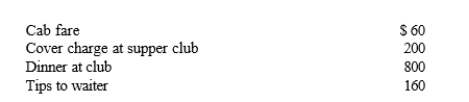

Robert entertains several of his key clients on January 1 of the current year.Expenses that he paid are as follows:  Presuming proper substantiation, Robert's deduction is:

Presuming proper substantiation, Robert's deduction is:

Definitions:

Simplified Version

An easier or less complex form of something, often used to aid understanding or analysis.

Minimum Probability

The lowest chance or likelihood of an event occurring, often used in statistical analysis and decision-making processes to evaluate risk.

Costs

The expenses incurred in the production of goods or services, including materials, labor, and overhead.

Firm Indifferent

A state where a business has no preference between two or more choices due to equivalence in outcomes.

Q7: No E & P adjustment is required

Q18: The basis of property acquired in a

Q23: For tax purposes, travel is a broader

Q43: Short-term capital gain is eligible for a

Q53: AmCo and BamCo form the AB General

Q78: Xena and Xavier form the XX LLC.Xena

Q86: Surviving spouse filing status begins in the

Q87: The education tax credits (i.e., the American

Q92: Milton purchases land and a factory building

Q95: Jordan performs services for Ryan.Which of the