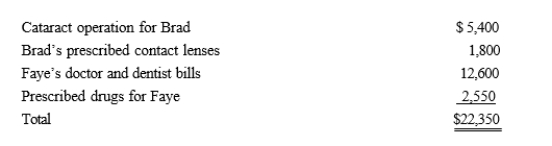

Brad, who would otherwise qualify as Faye's dependent, had gross income of $9,000 during the year.Faye, who had AGI of $120,000, paid the following medical expenses this year:  Faye has a medical expense deduction of:

Faye has a medical expense deduction of:

Definitions:

Future Cash Flows

the projected cash receipts and payments a business expects to incur over a future period, crucial for financial modeling and valuation.

Fully Authorized

Pertains to a company having received all necessary approvals or sanctions to issue shares or undertake actions as per its governance framework or regulatory requirements.

Provincial Government

The level of government responsible for governing the affairs of a province or territory, including making laws on regional matters.

Winter Festival

A seasonal celebration or event, typically held in the winter months, which can include various cultural, social, or sporting activities.

Q30: Alan, an Owl Corporation shareholder, makes a

Q50: The maximum credit for child and dependent

Q54: In 2019, Nai-Yu had the following transactions:

Q56: In 2019, Mary had the following items:

Q56: Capital assets donated to a public charity

Q72: Dan contributed stock worth $16,000 to his

Q90: The carryover basis to a donee for

Q93: The basis of inherited property usually is

Q96: Matt, a calendar year taxpayer, pays $11,000

Q118: Nancy paid the following taxes during the