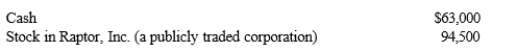

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor as an investment 14 months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is his charitable contribution deduction for the current year?

Ralph acquired the stock in Raptor as an investment 14 months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is his charitable contribution deduction for the current year?

Definitions:

Overhears

Accidentally hearing conversations or information not intended for one's ears.

Networking

The action or process of interacting with others to exchange information and develop professional or social contacts.

Off-Color Joke

Humor that is vulgar, inappropriate, or offensive in nature, usually relating to topics considered taboo or sensitive.

Applied Training

Practical, hands-on education or training aimed at developing specific skills relevant to a field or profession.

Q1: Under the simplified method, the maximum office

Q2: Roger is in the 35% marginal tax

Q4: Valarie purchases a rental house and land

Q7: During the current year, Jay Corporation, a

Q12: A decrease in the LIFO recapture amount

Q65: Which of the following would constitute an

Q66: Hannah, age 70 and single, is claimed

Q69: The amount of a business loss cannot

Q75: Nat is a salesman for a real

Q93: The basis of inherited property usually is