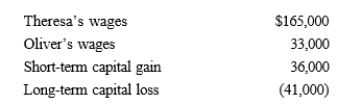

Theresa and Oliver, both over 65 years of age and married filing jointly, have no dependents.Their 2019 income tax facts are:  What is their taxable income for 2018?

What is their taxable income for 2018?

Definitions:

Book

A set of written, printed, or digital pages bound together and covered, containing text or illustrations.

The Great Gatsby

A classic American novel written by F. Scott Fitzgerald, exploring themes of decadence, idealism, and resistance to change in the 1920s.

Shakespearean Play

A dramatic work authored by William Shakespeare, famed for their rich language, complex characters, and profound themes.

Concept

An abstract idea representing the fundamental characteristics of what it represents.

Q9: Katie sells her personal use automobile for

Q36: A taxpayer can carry an NOL forward

Q40: Derek, age 46, is a surviving spouse.If

Q48: On June 1, 2019, James places in

Q75: A taxpayer's note or promise to pay

Q82: In 2019, Theresa was in an automobile

Q86: Under MACRS, which one of the following

Q107: Larry was the holder of a patent

Q118: In 2019, Mark has $18,000 short-term capital

Q121: The maximum amount of the § 121