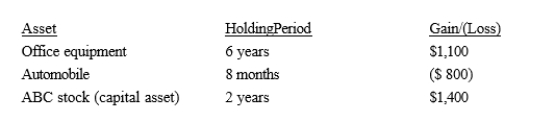

The following assets in Jack's business were sold in 2018:  Office equipment, purchased for $8,000, had a zero adjusted basis.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

Office equipment, purchased for $8,000, had a zero adjusted basis.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

Definitions:

Alertness

The state of being watchful and ready to meet potential dangers or emergencies; an enhanced state of sensory vigilance.

Visual Acuity

The clarity or sharpness of vision, measured as the ability to discern letters or numbers at a standardized distance according to a fixed standard.

Laboratory Test Results

The outcomes provided by laboratory examinations which are crucial for diagnosing, monitoring, and managing disease conditions.

Alcohol-Use Disorder

A medical condition characterized by an impaired ability to stop or control alcohol use despite adverse social, occupational, or health consequences.

Q7: During the current year, Jay Corporation, a

Q9: Zack was the beneficiary of a life

Q19: Confusingly, §1221 defines what is not a

Q34: Robin Corporation, a calendar year C corporation,

Q37: Services performed by an employee are treated

Q52: Qualified business income (QBI) is defined as

Q53: On their birthdays, Lily sends gift certificates

Q82: In 2019, Theresa was in an automobile

Q94: In January, Lance sold stock with a

Q119: A major objective of MACRS is to:<br>A)Reduce