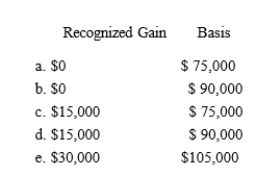

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Definitions:

Connector

A device used to join electrical terminations and create an electrical circuit; connectors come in various sizes and shapes for different purposes.

Input Devices

Input devices are peripherals used to provide data and control signals to a computer, such as keyboards, mice, and scanners.

Digitizer

A device or software that converts analog information into digital form, often used in the context of touchscreens and drawing tablets to interpret touch or stylus input.

Q10: Jogg, Inc., earns book net income before

Q19: Mary Jane participates for 100 hours during

Q21: Which of the following is correct?<br>A)The gain

Q23: The only thing that the grantee of

Q34: $1,100

Q36: Create, Inc., a domestic corporation, owns 100%

Q49: The taxable portion of Social Security benefits

Q68: Sergio was required by the city to

Q105: Which of the following is not a

Q128: The Hutters filed a joint return for