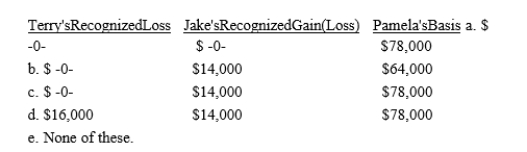

Terry owns Lakeside, Inc.stock (adjusted basis of $80,000), which she sells to her brother, Jake, for $64,000 (its fair market value).Eighteen months later, Jake sells the stock to Pamela, a friend, for $78,000 (its fair market value).What is Terry's recognized loss, Jake's recognized gain or loss, and Pamela's adjusted basis for the stock?

Definitions:

Unduly Influenced

A legal term referring to a situation where an individual is persuaded or coerced into acting against their free will or best interest, often in contracts or wills.

Tax Evasion

The illegal act of not paying taxes that are legally owed, often by concealing income or inflating deductions.

Intentional Wrongful Disclosure

The deliberate release or sharing of confidential or protected information without permission, usually leading to harm or breach of trust.

Additional Sums

Extra amounts of money required or due on top of the originally agreed upon or standard payment.

Q13: The cost of repairs to damaged property

Q33: If a taxpayer exchanges like-kind property and

Q38: If Wal-Mart stock increases in value during

Q51: In recent years, Congress has been relatively

Q55: South, Inc., earns book net income before

Q72: In computing the amount realized when the

Q74: Assuming a taxpayer qualifies for the exclusion

Q113: A corporation has a $50,000 short-term capital

Q120: Kim, a resident of Oregon, supports his

Q126: Phyllis, who is single, has itemized deductions