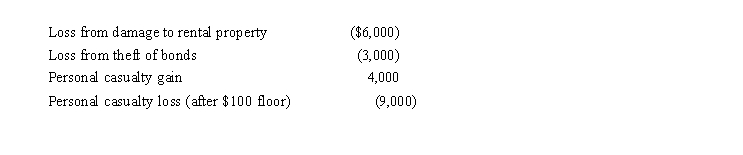

In 2019, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  The personal casualties occurred in a Federally declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

The personal casualties occurred in a Federally declared disaster area.Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Formal Education

An organized and structured form of learning delivered by trained teachers and educational institutions.

High School Diploma

A certificate awarded by educational institutions upon completion of secondary education, meeting the requirements for graduation in a given country or state.

Canadians

Citizens of Canada or people residing in Canada, often recognized for their diverse cultural backgrounds.

Anti-racist

Refers to practices, policies, and philosophies that actively confront and challenge racism and its effects on societies.

Q2: ASC 740 addresses how an entity should

Q8: Tan Company acquires a new machine (10-year

Q19: Mary Jane participates for 100 hours during

Q50: Andrew, who operates a laundry business, incurred

Q53: Black, Inc., is a domestic corporation with

Q61: Kim dies owning a passive activity with

Q68: Debby, age 18, is claimed as a

Q73: On May 30, 2018, Jane purchased a

Q77: In terms of the tax formula applicable

Q80: Tommy, an automobile mechanic employed by an