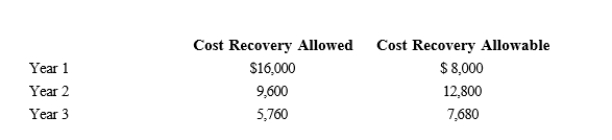

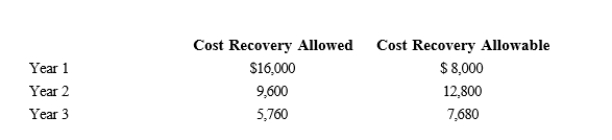

Tara purchased a machine for $40,000 to be used in her business.The cost recovery allowed and allowable for the three years the machine was used are computed as follows.

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

If Tara sells the machine after three years for $15,000, how much gain should she recognize?

Definitions:

Circadian Theory

A theory that explains the 24-hour cycle of physiological processes of living beings, including the sleep-wake cycle, influenced by external cues like light and temperature.

NREM Sleep

Non-Rapid Eye Movement Sleep, a restorative sleep phase that includes stages 1 through 3, characterized by progressively deeper levels of relaxation and reduced physiological activity.

Growth Hormone

A peptide hormone that stimulates growth, cell reproduction, and cell regeneration in humans and other animals.

Brain Activity

The functioning of the brain involving complex processes signaled by electrical impulses and chemical neurotransmitters.

Q20: Section 1033 (nonrecognition of gain from an

Q28: If a corporation has no operations outside

Q28: Hiram is a computer engineer and, while

Q35: The value added tax (VAT) has not

Q48: In the case of a below-market gift

Q64: Taxpayers may elect to use the straight-line

Q79: Bria's office building (basis of $225,000 and

Q81: The only asset Bill purchased during 2019

Q90: A landlord leases property upon which the

Q97: Karen purchased 100 shares of Gold Corporation