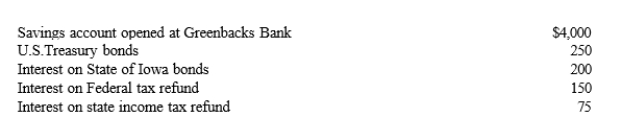

Doug and Pattie received the following interest income in the current year:  Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

Greenbacks Bank also gave Doug and Pattie a cellular phone (worth $100) for opening the savings account.What amount of interest income should they report on their joint income tax return?

Definitions:

Promissory Estoppel

A judicial doctrine that bars an individual from retracting a commitment once the other individual has justifiably depended on that pledge to their disadvantage.

Moving Expenses

Costs associated with relocating from one residence or office location to another, which sometimes are covered by employers.

Accountant

A professional who performs financial functions related to the collection, accuracy, recording, analysis, and presentation of a business, organization, or individual's financial operations.

Bankrupt Debtor

A person or entity that has been legally declared unable to pay their debts, leading to a bankruptcy proceeding.

Q5: Post-1984 letter rulings may be substantial authority

Q17: A taxpayer can obtain a jury trial

Q28: If a corporation has no operations outside

Q32: The tax concept and economic concept of

Q36: Simpson Company, a calendar year taxpayer, acquires

Q38: If a noncorporate taxpayer has an excess

Q43: Propagation mechanisms include system corruption, bots, phishing,

Q79: A deduction for contributions by an employee

Q98: In 2015, Harold purchased a classic car

Q127: Goodwill associated with the acquisition of a