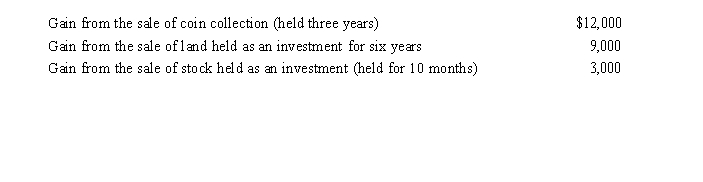

During 2019, Jackson, a single taxpayer, had the following capital gains and losses:

a.How much is Jackson's tax liability if his taxable income is $32,000 and he is in the 12% tax bracket?

b.How much is his tax liability if his taxable income is $171,000 and his tax bracket is 32% (not

12%)?

Definitions:

Generalized

A concept or conclusion extended from specific examples to broader contexts; making general assumptions or predictions based on limited data.

Targeted

Directed or aimed at a specific object, group, or goal.

Job Burnout

A state of physical, emotional, and mental exhaustion caused by prolonged stress and frustration at the workplace.

Mental Exhaustion

A state of extreme fatigue resulting from mental effort or stress, often reducing productivity and motivation.

Q9: System administrators can stop all attacks and

Q11: Insider attacks are among the easiest to

Q11: Property can be transferred within the family

Q11: A taxpayer is considered to be a

Q17: The _ MIME field is a text

Q26: The _ method uses information contained on

Q65: Federal tax legislation generally originates in which

Q68: Which of the following indicates that a

Q79: Heather's interest and gains on investments for

Q94: In January, Lance sold stock with a