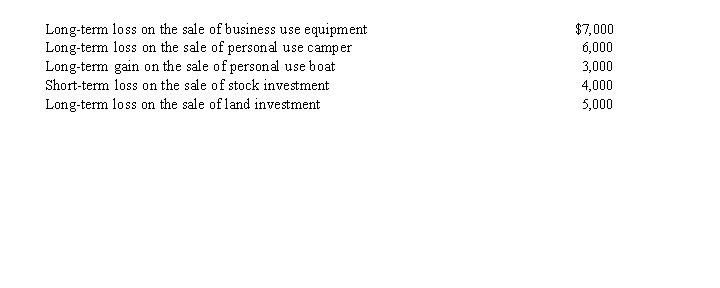

During the year, Irv had the following transactions:  How are these transactions handled for income tax purposes?

How are these transactions handled for income tax purposes?

Definitions:

Total Compensation

The complete pay package for employees, including salary, bonuses, benefits, and any other financial rewards.

Sophisticated Computer Systems

Advanced and highly developed computer technologies that offer superior capabilities in processing, analysis, and user interaction.

Flexible Benefit Plans

Employee benefit programs allowing workers to choose from a variety of pre-tax benefits to tailor their compensation package to their needs.

Skill-Based Pay

A compensation system that bases an employee's pay on the skills, knowledge, and abilities they bring to a job, rather than their position or title.

Q14: Pedro borrowed $250,000 to purchase a machine

Q18: Healy, Inc., reports an effective tax rate

Q22: Which of the following taxes are included

Q36: If the amount of a corporate distribution

Q40: The following citation could be a correct

Q44: Theresa, a cash basis taxpayer, purchased a

Q68: Which of the following indicates that a

Q77: Daniel purchased a bond on July 1,

Q102: Hazel purchased a new business asset (five-year

Q124: In 2019, Grant's personal residence was completely