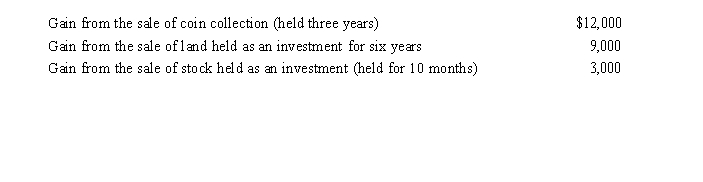

During 2019, Jackson, a single taxpayer, had the following capital gains and losses:

a.How much is Jackson's tax liability if his taxable income is $32,000 and he is in the 12% tax bracket?

b.How much is his tax liability if his taxable income is $171,000 and his tax bracket is 32% (not

12%)?

Definitions:

Cost of Goods Sold

The immediate expenses related to producing the goods that a company sells, which involve both materials and labor.

Beginning Inventory

The cost of products on hand for selling at the commencement of an accounting cycle.

Inventory Turnover

A financial ratio measuring how many times a company's inventory is sold and replaced over a period.

Cost of Goods Sold

A duplicated term; refers to the direct costs attributable to the production of the goods sold by a company, including material and labor costs.

Q13: Sharon made a $60,000 interest-free loan to

Q14: Darryl, a cash basis taxpayer, gave 1,000

Q16: In December 2019, Todd, a cash basis

Q36: Microsoft Word, Excel files, and Adobe PDF

Q38: An end user whose system is equipped

Q39: The selectors that determine a Security Policy

Q76: Property that is classified as personalty may

Q77: Technical Advice Memoranda deal with completed transactions.

Q83: Three years ago, Sharon loaned her sister

Q99: At the beginning of 2019, Mary purchased