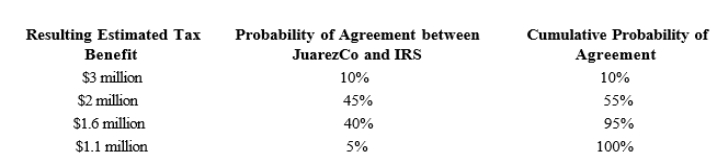

JuarezCo constructs the following table in determining how to apply ASC 740-10 to its filing position for its domestic production activities deduction.Its book-tax provision for the year, including $3 million for the uncertain transfer pricing issue, is $10 million.  Under ASC 740-10, JuarezCo's book income tax expense for this item is:

Under ASC 740-10, JuarezCo's book income tax expense for this item is:

Definitions:

GAAP

Generally Accepted Accounting Principles, the standard framework of guidelines for financial accounting used in any given jurisdiction, notably in the United States.

Limited Liability Company

A business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Tax Treatment

The specific methodology applied to determine the amount of taxes owed by an individual or business.

Limited Liability

A legal structure where a company's owners are not personally liable for the company's debts or liabilities.

Q6: Which court decision would probably carry more

Q14: IPsec policy is determined primarily by the

Q23: If an owner participates for more than

Q38: IEEE 802.11 is a standard for wireless

Q39: This Internal Revenue Code section citation is

Q63: Under MACRS, equipment falling in the 7-year

Q73: On January 1, Father (Dave) loaned Daughter

Q94: A taxpayer should always minimize his or

Q96: A loss is not allowed for a

Q104: The basis of personal use property converted