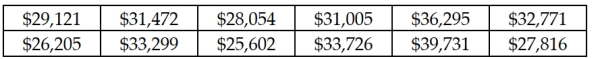

The National Club Association does periodic studies on issues important to its membership. The 2012 Executive Summary of the Club Managers Association of America reported that the average country club initiation fee was $31,912. Suppose a random sample taken in 2009 of 12 country clubs produced the following initiation fees:  Based on the sample information, can you conclude at the α = 0.05 level of significance that the average 2009 country club initiation fees are lower than the 2008 average? Conduct your test at the level of significance.

Based on the sample information, can you conclude at the α = 0.05 level of significance that the average 2009 country club initiation fees are lower than the 2008 average? Conduct your test at the level of significance.

Definitions:

Capital Asset Pricing Model

An approach outlining the connection between inherent risks and the expected return of assets, with a focus on stocks.

SML

The Security Market Line, a graphical representation used in the capital asset pricing model (CAPM) to show the relationship between the risk of an investment and its expected return.

Expected Return

The anticipated gain or loss on an investment, considering both the risk and return.

Expected Return

Expected return is the anticipated profit or loss from an investment, based on the potential outcomes and their probabilities, often used to evaluate investment choices.

Q15: In a hypothesis test involving two population

Q45: A report in a consumer magazine indicated

Q80: Which of the following statements is true

Q83: A contract calls for the mean diameter

Q83: A commuter has two different routes available

Q113: If the population variances are assumed to

Q113: In analyzing the sampling distribution of a

Q120: Which of the following describes a treatment

Q144: The makers of Mini-Oats Cereal have an

Q173: If the probability of a Type I