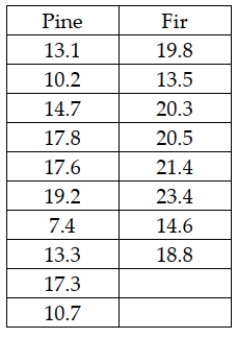

The Sergio Lumber Company manufactures plywood. One step in the process is the one where the veneer is dried by passing through a huge dryer (similar to an oven) where much of the moisture in the veneer is extracted. At the end of this step, samples of veneer are tested for moisture content. It is believed that pine veneer will be less moist on average than will fir veneer. The following data were reported recently where the values represent the percent of moisture in the wood:  The null and alternative hypotheses to be tested are

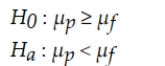

The null and alternative hypotheses to be tested are

Definitions:

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (income, spending, etc.), indicating the percentage of total income or spending that is paid in taxes.

Marginal Tax Rate

The marginal tax rate is the rate at which the last dollar of income is taxed, reflecting the proportion of additional income that is paid in taxes.

Progressive Tax

A tax system where the tax rate increases as the taxable amount or income goes up, making it proportionately higher for wealthier individuals or entities.

Individual Income

The total earnings received by an individual from all sources, including wages, investments, and other forms of compensation.

Q5: For the following hypothesis: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3074/.jpg" alt="For

Q18: In a two-tailed hypothesis test for the

Q18: In developing a confidence interval estimate for

Q37: The test statistic that is used when

Q64: One of the major automobile makers has

Q78: Even before the record gas prices during

Q99: The J.R. Simplot Company produces frozen French

Q129: A large orchard owner in the state

Q132: A study was recently conducted to see

Q157: In an application to estimate the mean