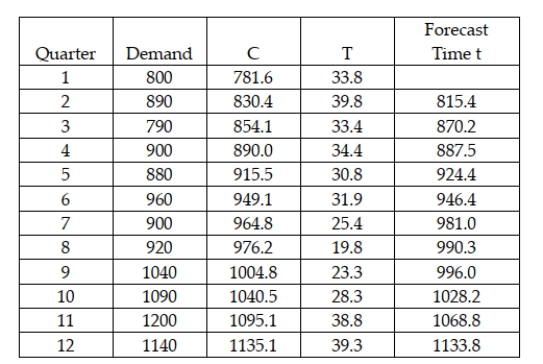

The Wilson Company is interested in forecasting demand for its XG-667 product for quarter 13 based on 12 quarters of data. The following shows the data and the double exponential smoothing model results for periods 1-12 using alpha = 0.20 and beta = 0.40  Based on this information, what is the difference between the forecast for period 13 using smoothing constants of alpha = 0.20 and beta = 0.40 and smoothing constants of alpha = 0.10 and beta = 0.30? (Assume that the starting values for period 0 are C = 745 and T = 32.)

Based on this information, what is the difference between the forecast for period 13 using smoothing constants of alpha = 0.20 and beta = 0.40 and smoothing constants of alpha = 0.10 and beta = 0.30? (Assume that the starting values for period 0 are C = 745 and T = 32.)

Definitions:

Safety Stock

Additional inventory kept on hand to guard against stockouts caused by uncertainties in demand and lead-time.

Kanbans

A scheduling system for lean manufacturing and just-in-time (JIT) production that signals the need to move materials within a production facility.

Push Production

A manufacturing system where production is based on forecasted demand and items are produced and pushed to the next stage of the process regardless of actual demand.

Kaizen

A Japanese term for 'continuous improvement', focusing on small, incremental changes in processes to improve efficiency and quality.

Q19: Leaders influence people to change by providing

Q20: Based on the correlations below: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3074/.jpg"

Q21: We want to test whether type of

Q28: In using simple linear regression to find

Q36: Which of the following in not an

Q42: In conducting a Mann-Whitney U test when

Q46: A decision maker has five potential independent

Q75: A company's annual sales are shown below

Q83: If a two-tailed Wilcoxon Matched-Pairs Signed Rank

Q114: The Baker's Candy Company has been in