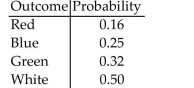

Determine whether the following is a probability model.

-

Definitions:

Little Albert

An early 20th-century experiment by John B. Watson and Rosalie Rayner, demonstrating classical conditioning in a young child.

White Rat

Commonly used in psychological experiments, particularly in the study of behavior, learning, and conditioning; often associated with B.F. Skinner's work.

Conditioned Stimulus

A previously neutral stimulus that, after association with an unconditioned stimulus, elicits a conditioned response.

White Rat

Commonly used in psychologic and medical research, a laboratory rat of a breed that is white in color.

Q1: <span class="ql-formula" data-value="\sum _ { k =

Q3: A researcher wishes to determine whether

Q8: The following boxplots show monthly sales revenue

Q8: A sample of 33 companies was

Q9: The US Census reported the following counts

Q10: Do energy snack bars improve afternoon alertness?

Q14: Finite-state automata <span class="ql-formula" data-value="A"><span

Q16: Consider the statement: <span class="ql-formula"

Q40: Mary finds 10 fish at a pet

Q90: f(x) = (x - 2)(x - 5)<br>A)